Below some positive news for all of us who are driving circularity!

The article is translated from German and was originally published on https://www.euwid-recycling.de/ at 05.04.2023 by Stefan Lang.

The proportion of recycled material in PET beverage bottles has increased significantly. According to a study by GVM (= Gesellschaft für Verpackungsmarktforschung), an average of 44.8 percent PET recyclate was used in the production of beverage bottles in Germany in 2021. In the last survey for 2019, it was still 34.4 percent.

However, the consumption of PET for bottle production fell by 4.5 percent or 21,400 tonnes to 446,000 tonnes compared to 2019. One reason for this is that the bottles are becoming lighter and lighter, according to the study “Aufkommen und Verwertung von PET-Getränkeflaschen in Deutschland 2021” (Volume and recycling of PET beverage bottles in Germany 2021), which was commissioned by Forum PET and the IK (= Industrievereinigung Kunststoffverpackungen). But declines in demand and substitution by glass bottles would also have resulted in a decrease in PET volumes.

According to the study, the recycling rate of all PET beverage bottles was 94.8 percent on average in 2021. The recycling rate for PET bottles with a deposit (one-way and refillable) was as high as 97.7 percent. The return rate for PET bottles with a deposit (single-use and reusable) reached 98.7 percent.

Around 438,000 tonnes of PET beverage bottles, including imports, were recycled in Germany. Of this, the largest share (190,500 tonnes or 44.7 percent) ended up in the production of new bottles, while the film industry took about 114,000 tonnes (26.8 per cent). Other sectors such as non-food bottles, tapes and injection moulded products recycled more than 73,000 tonnes of PET recyclate, while the fibre industry took another 48,000 tonnes (11.3 percent). About 33,600 tonnes of PET from bottle sorting and reprocessing as well as misdirected into residual waste were incinerated.

According to GVM, recycling capacities in Germany exceed the available PET quantities. In order to exhaust the recycling capacities, the import of bottles is necessary. GVM puts the import surplus at 15,000 tonnes.

Although the price for PET recyclates increased very strongly in 2021, bottlers used more recyclates in beverage bottles than in previous years. According to GVM, the reason for the higher use rates was, among other things, the commitments made by large bottlers to use recyclates.

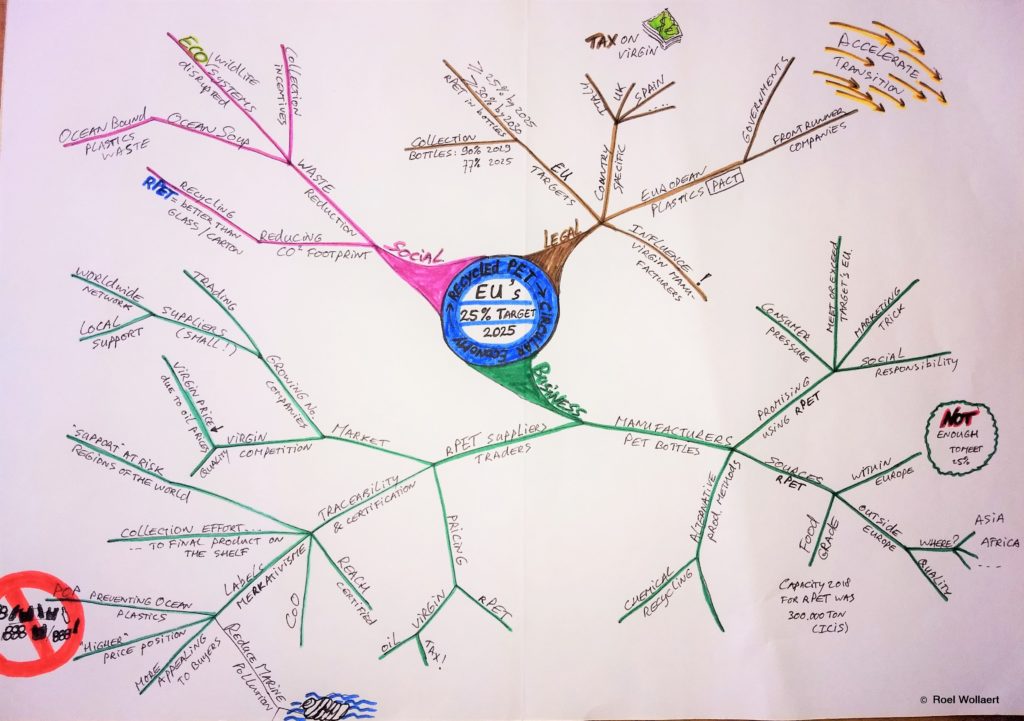

IK sees great potential through expansion of deposit systems in Europe

For the IK, high quotas are “proof of the efficiency” of the German deposit system for beverage bottles. “We see great potential across Europe and hope that more European countries will also establish deposit systems close to the future,” says IK Managing Director Isabell Schmidt. Since 1 January 2022, juice bottles have also been included in the deposit system. With milk bottles, which will follow in 2024, all PET beverage bottles, returnable and non-returnable, will be subject to a deposit, according to the IK. The beverage industry expects the use of PET recyclate to continue to increase in the coming years. On the one hand, the manufacturers and distributors of PET beverage bottles want to achieve the sustainability goals they have set themselves. On the other hand, the EU’s Single-Use Plastics Directive (SUPD) requires that from 2025 onwards, PET single-use beverage bottles throughout Europe have an average recycled content of at least 25 percent.